If you run IT in a bank, credit union, or insurance organization, you are carrying more weight than ever. AI projects are moving faster, fraud is hitting harder, instant payments are changing infrastructure needs, and regulatory expectations seem to expand monthly. At the same time, your environment spans cloud-native apps, legacy systems, digital channels, branch systems, and a growing ecosystem of third-party integrations.

You don’t need a high-level industry trend report. You need clarity on how to modernize safely, scale efficiently, and stay compliant without slowing the business down. That is exactly what our new white paper delivers.

AI Is Becoming Operational, Not Experimental

AI is showing up in underwriting, claims, customer support, software development, and risk analysis. McKinsey estimates up to 30% of banking activities could be automated, but that potential only matters if the underlying infrastructure is ready. Governance, lineage, transparency, and monitoring are no longer “future concerns.” They are core requirements for deploying AI safely and proving business value.

Cyber Resilience Must Stretch Across Every Environment

Financial institutions face some of the highest cyber costs of any industry, with nearly six million dollars per breach on average. Ransomware attacks against banks have surged, and real-time payment fraud has compressed incident detection from hours to seconds. IT teams are strengthening identity controls, segmentation, and observability to keep up. Regulators expect nothing less.

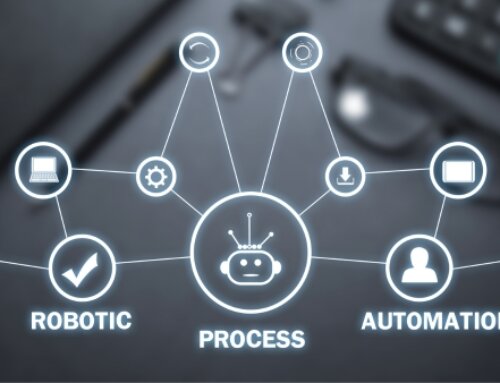

Instant Payments and ISO 20022 Are Reshaping How Systems Must Work

Supporting RTP and FedNow demands low-latency, always-on infrastructure and fraud engines that can operate in near real time. ISO 20022 adds the need for richer, structured data pipelines. IT teams are upgrading payment systems, analytics platforms, and downstream integrations to support faster screening, better automation, and improved straight-through processing.

Tokenization and Digital Assets Are Moving From Concept to Planning

Tokenized funds, on-chain settlement, and digital asset pilots are no longer theoretical. They bring real implications for data lineage, custody integration, governance, and compliance. IT leaders are being pulled in early to ensure these emerging capabilities are supported without exposing core systems to new risks.

Data and Analytics Requirements Are Tightening

Capital and market risk rules are driving the need for more granular data, stronger lineage, and faster regulatory reporting. Many organizations are modernizing analytics pipelines and expanding hybrid cloud capacity to support increasingly complex models and audit expectations.

Cloud and Branch Modernization Are Essential, Not Optional

Hybrid cloud adoption continues, but maturity remains low. As many as 82% of financial leaders view hybrid cloud as essential, yet fewer than half feel confident in their execution. At the same time, branch environments often rely on aging hardware and inconsistent patching. Modernizing data foundations, replatforming legacy apps, and improving edge resiliency are critical steps toward reducing operational risk.

Zero Trust and Managed Services Fill the Gaps

As hybrid work expands and fintech integrations multiply, Zero Trust security is becoming the new baseline for regulators and insurers. Meanwhile, talent shortages in cybersecurity, cloud architecture, and data engineering are pushing IT leaders to rely more on managed services. The goal isn’t outsourcing for cost savings. It is stabilizing operations so internal teams can focus on modernization and innovation.

Want Practical Guidance and Real Answers? Get the Full White Paper

If you’re navigating these pressures firsthand, you need more than surface-level insights. Our full white paper dives deeper into:

- How to operationalize AI securely and at scale

- How to strengthen cyber resilience across cloud, branch, and third-party ecosystems

- What instant payments and ISO 20022 really mean for infrastructure

- How to prepare for tokenization and digital asset pilots

- Where cloud, edge, and data modernization deliver the most ROI

- How managed services support modernization when talent is scarce

It is written specifically for financial IT leaders who are dealing with these issues in real environments today.

Get the full white paper and explore practical steps to modernize your financial IT foundation with confidence.

If you’d like help prioritizing next steps, Verinext is here to support your roadmap.